Check out other articles

Blog

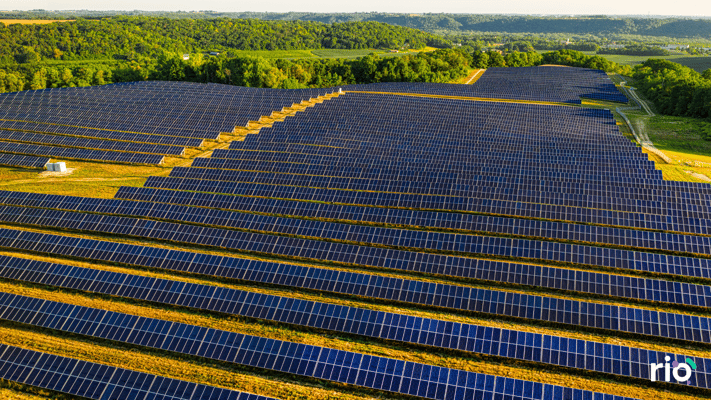

Empowering Private Equity through Sustainability Integration

14 April, 2025 / Events,

Blog

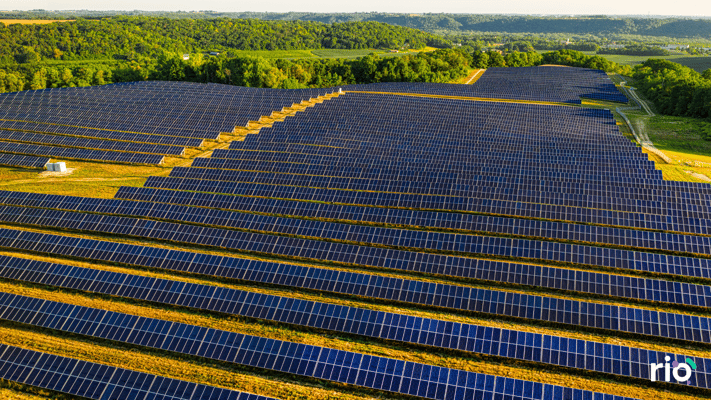

Streamline Sustainability in PPP Projects with Rio AI

18 March, 2025 / Industry, Innovation, and Infrastructure, Decarbonisation,

Blog