According to a recent survey by Morningstar Sustainalytics, 90% of companies either have or are developing a formal strategy to manage corporate environmental, social, and governance practices. This follows on the heels of a ‘Sustainability Action Report’ commissioned by Deloitte in December 2022, which revealed that 99% of public companies expect to invest in ESG reporting tech and tools in the next 12 months.

The Deloitte report goes on to state that in order to address ESG data and reporting needs, virtually all (99%) respondents said that they were somewhat or very likely to invest in more disclosure-focused technology and tools in the next 12 months, and more than 80% reported that their companies have new roles or responsibilities to prepare for increased disclosure requirements.

Both reports highlight the ever-increasing momentum in implementing sustainability strategies and ramping ESG reporting initiatives, with corporate sustainability teams increasingly at the centre of important business discussions. Like other areas of compliance, access to accurate data and the ability to process it will be key to the time, resource and cost of remaining compliant.

Whilst there is no common standard worldwide on ESG scoring, reporting and disclosure, there is a global trend to create a standard ESG baseline. For example, reporting on Scope 3 emissions will be included as part of required company disclosures early this year, marking a significant milestone in the development of climate and sustainability-related reporting standards for companies.

According to the Deliotte report, Scope 3 emissions data appears to be a top concern, with only 37% currently prepared to disclose on Scope 3, compared to 61% on Scope 1 and 76% on Scope 2. Top Scope 3 challenges reported by respondents included the quality of data from external vendors at 51% and a lack of data availability at 41%.

Scope 1: Direct emissions generated by the company

Scope 2: Indirect emissions from immediate vendors or utilities that supply the company

Scope 3: All indirect emissions throughout the value chain worldwide

Getting ESG-ready in 2023

The biggest challenge for companies worldwide will be reporting on Scope 3 emissions, with many organisations Scope 3 emissions accounting for about 70% of total GHG footprint. However, Scope 3 emissions are typically the hardest to track and calculate, occurring outside of the direct control of companies, in areas such as supply chains, or in their customers’ use of their products.

Examples of Scope 3 emissions:

- Emissions from the extraction of raw materials used in manufacturing

- Emissions from the manufacturing of products used by the organisation

- Emissions from the downstream usage of products or services

- Emissions from waste disposal

- Emissions from business travel

How can Rio help you?

Understanding the basics of the GHG protocol and the different emissions scopes will help you as you begin reporting on your organisation’s emissions. Once you’ve established regular, comprehensive reporting, you can begin working towards your net zero targets and tracking progress over time.

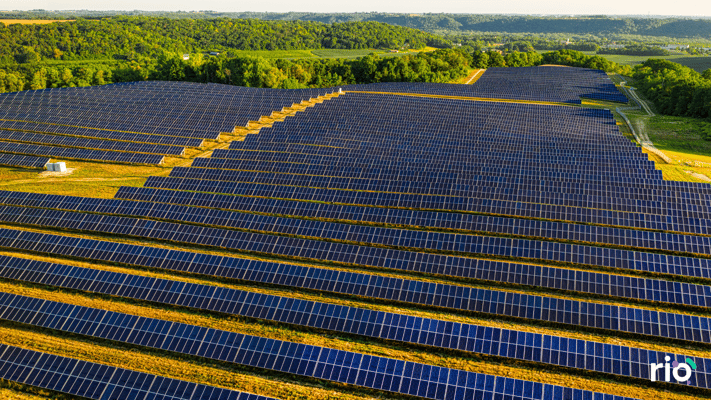

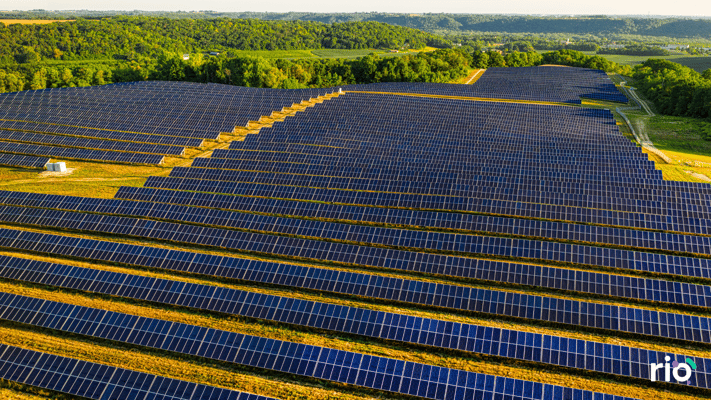

Tracking and reporting on emissions is challenging. Rio’s intelligent sustainability software makes it simpler, automatically sorting emissions into Scopes 1, 2, and 3 using industry-standard guidance provided by the GHG Protocol.

We dig into the basics of the GHG Protocol, explain the different scopes, and discuss how organisations can use these standards in their reporting.

Here’s how it works:

We combine inputs like your data on waste, utility usage, and transportation; external data like current market pricing and international VAT rates; and industry expertise.

Our AI engine processes this information, collecting further data via the chatbot interface, to offer trustworthy, tailored, transparent advice at scale and on demand.

ESG reporting is a starting point, not the finish line. That’s why Rio makes it easier and more affordable than ever to get from disclosure to meaningful action.

Learn more about our technology, or contact us to find out how Rio can help with your ESG initiatives.